Childminding

Welcome to Roscommon County Childcare Committee’s Childminding section. On this page you will find useful information and resources to support you to set up, conduct and register your childminding business.

What is a Childminder/Childminding Service:

A childminding service involves an individual taking care, by themselves, of children under the age of 15 years, for payment, in the childminder’s home. A childminder is self-employed and provides a paid childcare service for a minimum of 2 hours a day in their own home. If you are employed by a child’s parents and you look after the child/children in their home, you cannot register as a childminder. If you only mind children who are closely related to you, e.g. your grandchildren or nieces/nephews, you do not need to register as a childminder.

Roscommon County Childcare Committee offer a range of supports to all existing and potential Childminders. All Childminders and intending childminders are encouraged to engage with Roscommon CCC’s Childminding Development Officer, Maria Corrigan.

- Email: maria.corrigan@roscommonchildcare.ie

- Tel: 094 9622540

Roscommon CCC provides information and supports on:

- Updates on the National Action Plan for Childminding

- Networking events to link in with other childminders from your locality

- Support in setting up a childminding service in your own home

- Support in accessing grants and funding i.e. National Childminding Development Grant

- Access to training and information i.e. First Aid, Fire Safety, and Always Children First Training, Pre-registration Training etc.

- Register with Tusla

- Offer the National Childcare Scheme (if applicable)

- Connect with parents who are seeking childminding care

- Childminding Directory- have their names included on a public list of Childminders which is made available to parents

- Information on current legislation and any changes in law.

The National Action Plan for Childminders (2021-2028)

The National Action Plan for Childminding is a pathway to be developed over the next 8 years that sets out steps towards regulation, support and subsidies, for all paid, non-relative childminders. The Action Plan will involve change and significant benefits for childminders, children and the families using their services.

The aim of the Action Plan is to provide greater recognition for childminding and to support childminders in their work of providing high quality early learning and care and school age childcare, thus supporting child development and learning outcomes and helping families.

1. Childminding Pre-Registration Training

The Childminding Pre-Registration training is a mandatory course for anyone who intends to register with Tusla for a childminding service.

To take this training course you must be:

- 18 years old or over

- Self-employed and providing a paid childcare service in your own home

- Either currently working as a childminder and intending to register with Tusla, or intending to work as a childminder and register with Tusla. If you are unsure as to whether or not you are eligible to register with Tusla, contact your local Childminding Development Officer for information and support.

The aim of the training programme is to help you:

- Understand the new childminding regulations.

- Apply the regulations to your childminding practice.

- Understand the Tusla registration process for childminders.

- Understand the documentation required to register with Tusla.

- Access supports and resources.

To register your interest in attending a Pre-Registration course please complete the expression of interest form (can I link the EOI form to this please) or for further information, contact our offices on 094 9622540 or email maria.corrigan@roscommonchildcare.ie

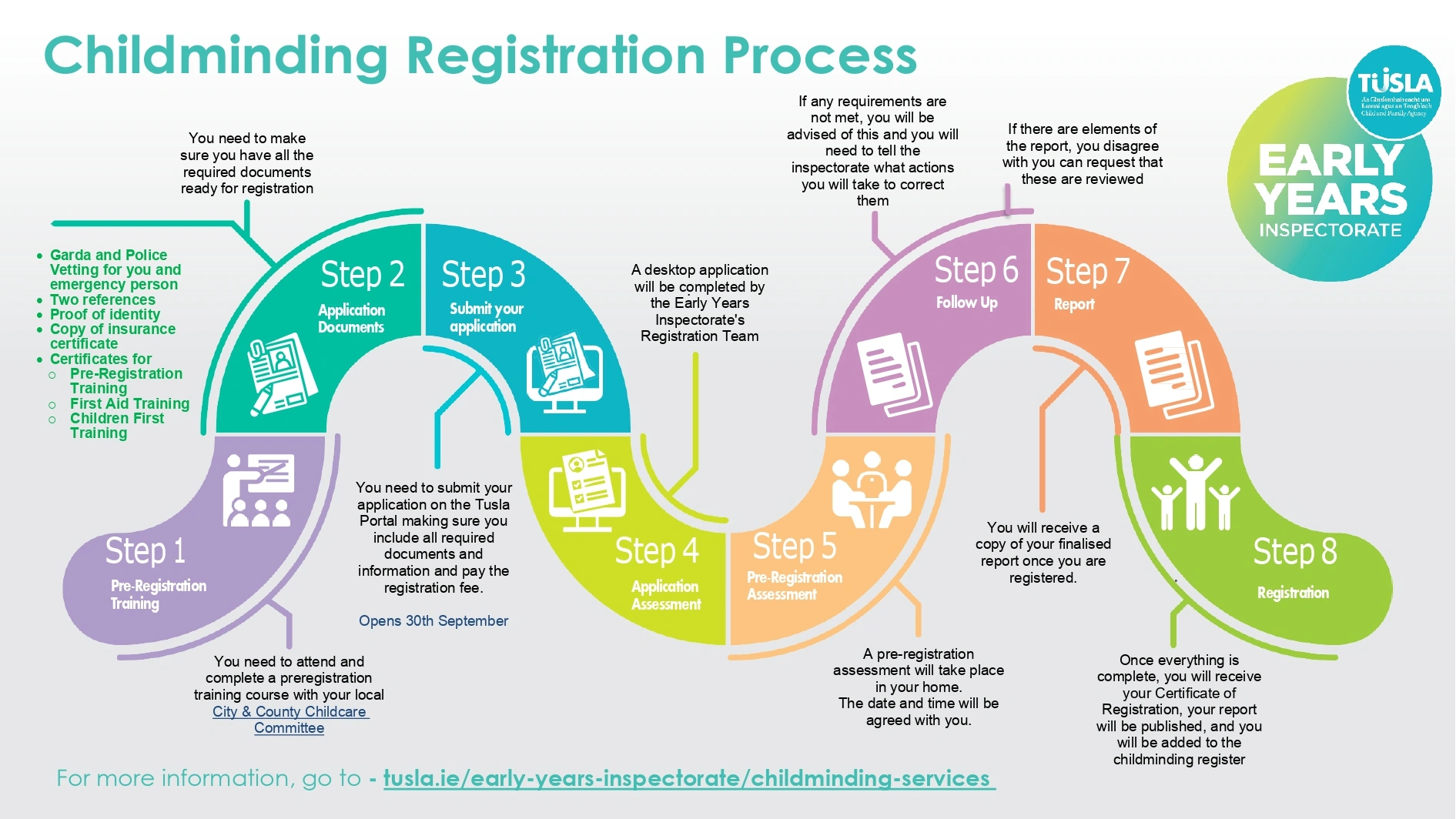

2. Childminding Regulations & Tusla Registration Process

Under the new Child Care Act 1991 (Early Years Services) (Childminding Services) Regulations 2024 all Childminders must register with Tusla. Childminders can apply for Tusla registration through a dedicated portal, accessed at www.tusla.ie. Tusla will provide a supportive compliance approach by working with Childminders to help them achieve registration.

To register with Tusla you must have the following documents:

- Garda Vetting & Police clearance for the childminder & emergency cover person/s

- Proof of identity

- Copy of insurance certificate

- Certificates for Pre-Registration Training, First Aid training and Children First Training

Tusla – Child and Family Agency has a dedicated section on its website for childminding, found under the Early Years Inspectorate section, with a specific portal for applications, resources, FAQs, and guidance on the new regulations for childminders. You can find information on how to register, mandatory training, and contact details for support through this page and the dedicated portal at childminding.tusla.ie.

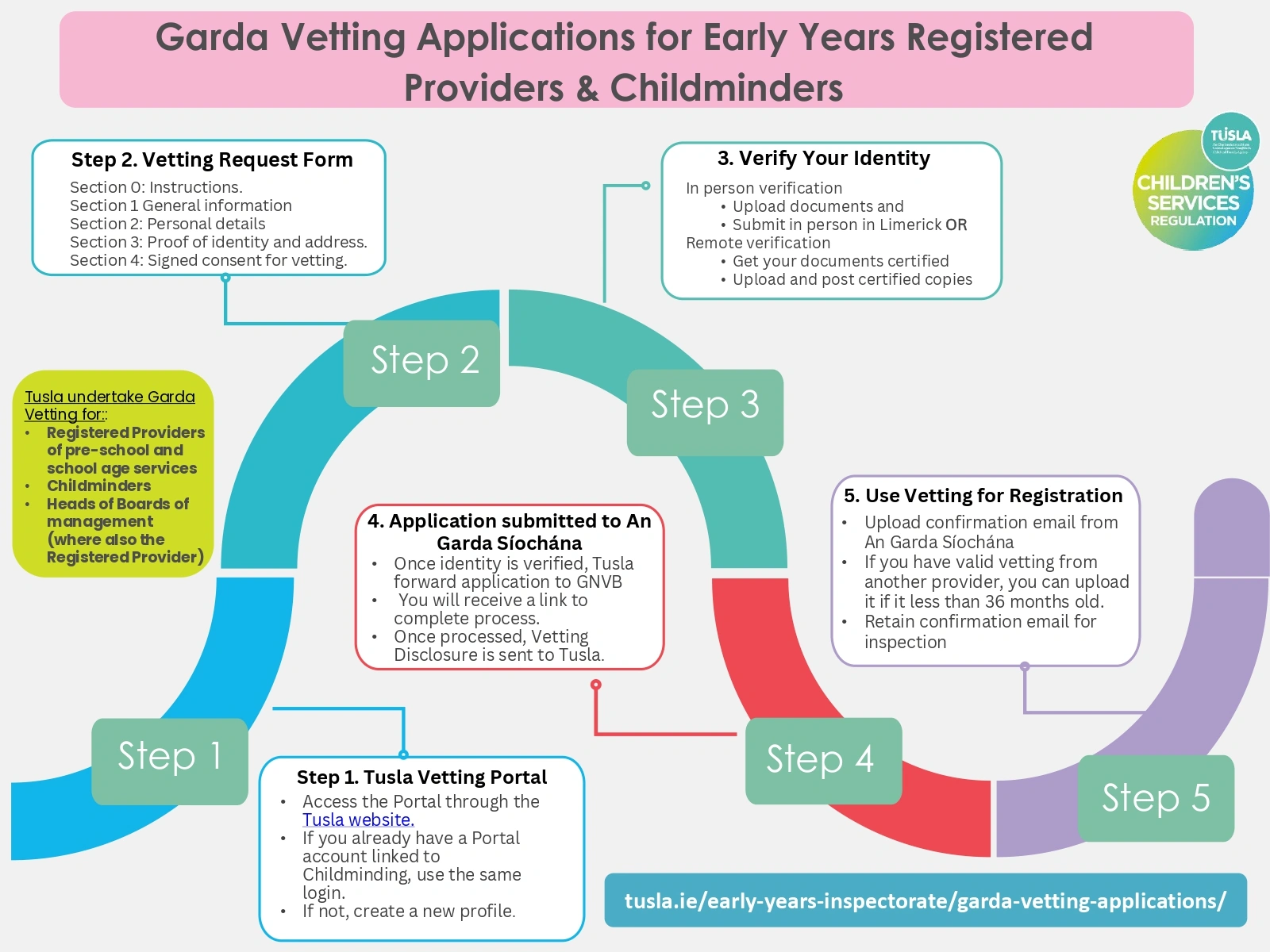

3. Garda vetting

From 1st February 2025, Tusla commenced providing the Garda Vetting Application Service for anyone who is a Registered Provider of an early year’s service (under part VIIA of the Child Care Act 1991, as amended) or anyone who is planning to submit an application to become a Registered Provider. In order to apply for Garda Vetting for the purpose of registration you will need to access the Tusla Garda Vetting portal. If you have a Portal account linked with a Childminding application, your profile username and password will work for Garda Vetting. If you have any other type of Portal account, you will need to create a new profile for the purposes of applying for Garda Vetting.

Tusla have a dedicated Garda Vetting section on their website and have developed a guidance document and an infographic to support Registered Providers and Childminders through the process of applying for Garda Vetting.

- Early Years Vetting unit contact number: 061 607199

- Email: EY.Vetting@Tusla.ie

4. Childminding Development Grant

The Childminding Development Grant for 2026 is yet to be announced.

5. Childcare Service Tax Relief

As a childminder you are running a business and earning an income therefore you must register with Revenue as a self-employed person. Childminders taking care of 3 or fewer children under the age of 18, may be entitled to avail of the Childcare Services Relief from the Revenue Commissioners, provided their annual childminding income exceeds no more than €15,000.

To apply for the Childcare Services Relief, Childminders are obliged to make an annual tax return of their childminding income to the Revenue Commissioners and must also provide evidence that they have notified their local City or County Childcare Committee.

The details of the scheme are as follows:

- The exemption applies only to Childminders who are self-employed

- The childminding service must be provided in the childminder’s own home

- The childminder may mind up to 3 children (under 18 years) at any one time, excluding the childminder’s own children. A childminder could, conceivably, mind 3 children in the morning and 3 different children in the afternoon and still qualify.

- The gross annual income from childminding cannot exceed the limit (currently €15,000).

- A childminder must submit an income tax return each year, even if there is no tax liability.

- A childminder will be required to pay a flat rate of PRSI for the year, currently €500. This is their contribution towards such benefits as Old Age Contributory Pension, Maternity Benefit.

For information on Applying for the Tax Exemption please refer to Childcare Services Relief- can we link the word “Childcare Service Relief” to this: Part 07-01-29 – Childcare Services Relief (section 216C)

If a Childminder does not apply for the Tax Exemption or is earning over €15,000 gross per annum, then their income is fully taxable. However, a Childminder is entitled to deduct a variety of expenses, which they may have incurred in earning that income, before tax is applied i.e. toys, equipment, food etc. specifically for the children being minded.